VMPL

Mumbai (Maharashtra) [India], September 18: As India’s economy continues to expand, driven by rising consumption, increasing disposable incomes, and growing demand supported by lower interest rates, the country’s leading companies–sector leaders–are uniquely positioned to capitalise on these emerging opportunities and shape the future of the economy. With the possibility of increased affordability through expected reductions in GST rates across a range of product categories, these companies not only drive economic growth but also present investors with a significant opportunity to build long-term wealth.

In light of this promising opportunity, Tata AIA Life Insurance (Tata AIA), one of India’s most trusted life insurers, is launching two new funds that allow investors to back India’s sector leaders while ensuring their families’ financial security with life insurance protection.

* Tata AIA Sector Leaders Index Fund – Invests in India’s top-performing companies that dominate their respective sectors, offering investors an opportunity to create long-term wealth.

* Tata AIA Sector Leaders Index Pension Fund – Available through Tata AIA’s unit-linked pension solutions, this fund is designed to help customers build a robust retirement corpus through systematic investments in sector leaders.

Both funds will be available for subscription at an initial price of ₹10 per unit during the New Fund Offer (NFO) period, which ends on September 22nd, 2025. Moreover, with the new GST norm coming into effect on September 22nd, 2025, these fund charges will be exempted from GST.

Investors can participate through Tata AIA Life Insurance’s unit-linked solutions, providing the combined advantages of life insurance coverage and long-term wealth creation.

Harshad Patil, Chief Investment Officer, Tata AIA Life Insurance, explains, “India’s growth is being driven by sector leaders who are strategically positioned to capitalise on rising demand and favourable policies. Our newly launched Sector Leaders Index Funds benefit from investing in an index which uses a disciplined approach to identify these top-performing companies and employ a systematic investment strategy to benefit investors. These funds enable our policyholders to capitalise on the wealth creation potential of the equity markets, while also offering financial protection for their families through investment in our ULIP solutions, ensuring they remain ‘Har Waqt Ke Liye Taiyaar.'”

Why Invest in Tata AIA’s Sector Leader Funds?

* Tap into India’s Growth Story: India’s economy is expanding rapidly, driven by rising consumption, formalisation and manufacturing push. These funds provide timely exposure to this transformation.

* Invest in Market Leaders: The funds track the BSE India Sector Leaders Customised Index, comprising up to three of the largest companies from each sector in the top 500 list, with exposure to 61 companies across 21 industries.

* Diversification with Discipline: The index follows a systematic, rule-based methodology that limits sector concentration, ensuring broad-based exposure without over-dependence on a single sector.

* Long-Term Wealth Creation: Sector leaders are resilient, large-scale businesses well-positioned for compounding returns over the long term.

* Retirement readiness: With the launch of the Sector Leaders Index Pension Fund, customers planning for retirement can build a robust, equity-led corpus, ensuring that their future lifestyle is backed by long-term market growth.

* Added Life Insurance Protection: Investors enjoy the additional benefit of life cover, providing financial security for their loved ones in the event of unforeseen circumstances.

Key Details of the Funds

* Investment Objective: Long-term capital appreciation by investing in stocks aligned to the Sector Leaders Index

* Benchmark: BSE India Sector Leaders Customised Index

* Asset Allocation: 80%-100% equity & equity-related instruments; 0%-20% cash & money market instruments

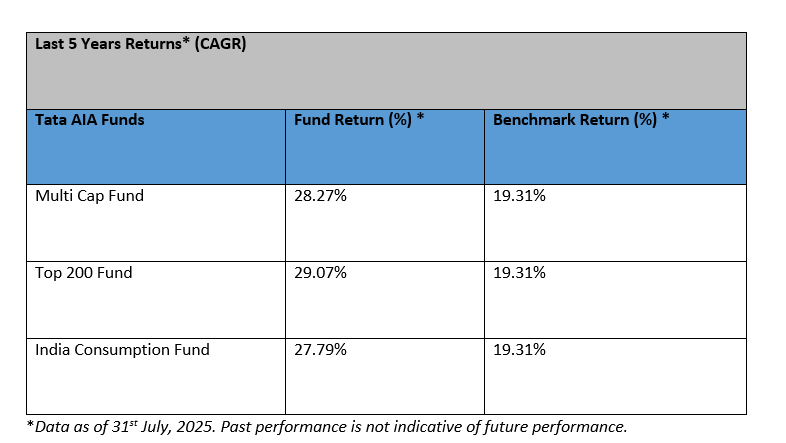

Proven Performance of Tata AIA Funds

As Tata AIA’s Sector Leaders Index Funds open for subscription, investors can rely on Tata AIA’s proven track record of delivering strong, long-term returns. The company’s funds have consistently demonstrated resilience in navigating market fluctuations, offering stable, growth-oriented returns.

With over 96% of Tata AIA’s rated AUM receiving 4 or 5-star ratings from Morningstar, Inc. as of July 2025, the globally recognized fund rating agency, Tata AIA’s performance stands as a testament to its ability to deliver value.

Tata AIA’s disciplined fund management and strategic investment methodology have enabled investors to optimise their wealth creation. This consistent performance positions Tata AIA as the preferred choice for those seeking growth, stability, and protection. It underscores the company’s unwavering commitment to providing innovative investment solutions that align with India’s evolving economic landscape, empowering investors to confidently capitalise on emerging opportunities.

Fund Benchmark: Multi Cap Fund – S&P BSE 200; India Consumption Fund- S&P BSE 200; Top 200 Fund- S&P BSE 200. SFINN: Multi Cap Fund – ULIF 060 15/07/14 MCF 110; Top 200 Fund- ULIF 027 12/01/09 ITT 110; India Consumption Fund – ULIF 061 15/07/114 ICF 110.

Inception Dates: Top 200 Fund: 12 Jan 2009, Multi Cap Fund: 05 Oct 2015, India Consumption Fund: 05 Oct 2015. Other fund are fund are also available this this solution

The funds will be available with Tata AIA ULIP solutions such as Tata AIA Smart Fortune Plus, Tata AIA Smart Sampoorna Raksha Pro, Tata AIA iSIP, Tata AIA Smart SIP, Tata AIA Capital Guarantee Solution, Tata AIA Smart Sampoorna Raksha Flexi and Tata AIA Smart Pension Secure.

About Tata AIA Life

Tata AIA Life Insurance Company Limited (Tata AIA) is a joint venture Company formed by Tata Sons Pvt. Ltd. and AIA Group Ltd. (AIA). Tata AIA Life combines Tata’s pre-eminent leadership position in India and AIA’s presence as the largest, independent listed pan-Asian life insurance group in the world, spanning 18 markets in the Asia Pacific region.

Tata AIA reported a total Premium Income of INR 31,484 crore for FY25, up 23% from FY24. The Company continues to rank among the Top 3 Private Insurers in Individual Weighted New Business Premium (IWNBP) with an IWNBP income of INR 8,511 crore. The Company also achieved industry-leading Persistency performance (based on premiums), ranking #1 in four out of five cohorts.

About the Tata Group

Founded by Jamsetji Tata in 1868, the Tata group is a global enterprise, headquartered in India, comprising 30 companies across ten verticals.

The group operates in more than 100 countries across six continents, with a mission ‘To improve the quality of life of the communities we serve globally, through long-term stakeholder value creation based on Leadership with Trust’.

In 2023-24, the revenue of Tata companies, taken together, was more than $165 billion. These companies collectively employ over 1 million people.

Each Tata company or enterprise operates independently under the guidance and supervision of its own board of directors. There are 26 publicly listed Tata enterprises with a combined market capitalisation of more than $365 billion as on March 31, 2024.

About AIA

AIA Group Limited and its subsidiaries (collectively “AIA” or the “Group”) comprise the largest independent publicly listed pan-Asian life insurance group. It has a presence in 18 markets -wholly-owned branches and subsidiaries in Mainland China, Hong Kong SAR(3), Thailand, Singapore, Malaysia, Australia, Cambodia, Indonesia, Myanmar, New Zealand, the Philippines, South Korea, Sri Lanka, Taiwan (China), Vietnam, Brunei and Macau SAR(4), and a 49 per cent joint venture in India. In addition, AIA has a 24.99 per cent shareholding in China Post Life Insurance Co., Ltd.

The business that is now AIA was first established in Shanghai more than a century ago in 1919. It is a market leader in Asia (ex-Japan) based on life insurance premiums and holds leading positions across the majority of its markets. It had total assets of US$305 billion as of 31 December 2024.

AIA meets the long-term savings and protection needs of individuals by offering a range of products and services including life insurance, accident and health insurance and savings plans. The Group also provides employee benefits, credit life and pension services to corporate clients. Through an extensive network of agents, partners and employees across Asia, AIA serves the holders of more than 43 million individual policies and 16 million participating members of group insurance schemes.

AIA Group Limited is listed on the Main Board of The Stock Exchange of Hong Kong Limited under the stock codes “1299” for HKD counter and “81299” for RMB counter with American Depositary Receipts (Level 1) traded on the over-the-counter market under the ticker symbol “AAGIY”

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)

Disclaimer: This story is auto-generated from a syndicated feed of ANI; only the image & headline may have been reworked by News Services Division of World News Network Inc Ltd and Palghar News and Pune News and World News

HINDI, MARATHI, GUJARATI, TAMIL, TELUGU, BENGALI, KANNADA, ORIYA, PUNJABI, URDU, MALAYALAM

For more details and packages